(Isbahaysi, Mogadishu) Some individuals are drawing comparisons between Somalia and East African Community (EAC) member states in terms of Value-Added Tax (VAT). However, such comparisons are not entirely appropriate given the significant economic disparities between Somalia and its EAC counterparts.

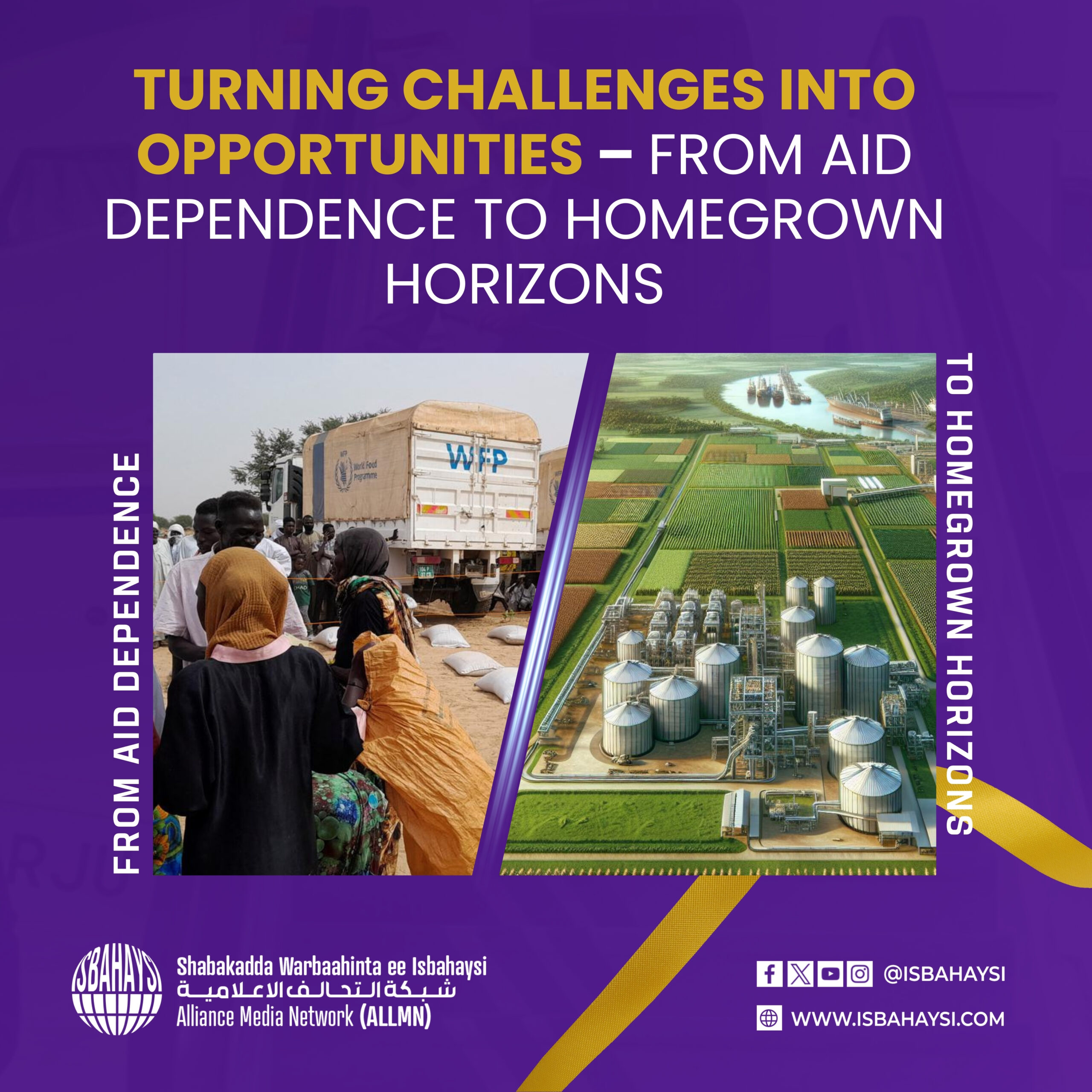

Somalia faces profound economic challenges. With unemployment rates exceeding 70%, a large portion of the Somali population is struggling to secure stable employment. Additionally, Somalia’s heavy reliance on imports for nearly all essential goods drives up the cost of living significantly. The country’s underdeveloped domestic production capacity means that it imports almost everything, from basic foodstuffs to energy supplies, making everyday necessities prohibitively expensive for the average Somali citizen.

In contrast, the citizens of EAC member states enjoy a more stable and diversified economy. They have access to a range of public services, which they pay for in their own currencies, contributing to economic stability. These countries have well-developed agricultural sectors, enabling them to produce and export various food items, which helps keep the cost of living relatively low. Furthermore, EAC member states benefit from better energy infrastructure, ensuring more reliable and affordable energy services for their populations.

Economically, EAC member states are in a stronger position due to their ability to produce and export goods, maintain a stable currency, and provide essential services to their citizens. Somalia, on the other hand, is grappling with high unemployment, a heavy reliance on imports, and a lack of sufficient infrastructure, particularly in the energy sector. These challenges make the economic environment in Somalia vastly different from that of EAC member states, highlighting the inappropriateness of direct comparisons, particularly concerning VAT and other fiscal policies.

In summary, while EAC member states are able to leverage their economic strengths to support their populations, Somalia’s economic vulnerabilities, including high unemployment and dependency on imports, create a fundamentally different context that must be considered when making any comparisons.

The Somali government has to use both fair and affordable taxes and economic diversification strategies to help the Somali people escape poverty. Taxing them alone in the capital will only make them poorer.